How do you build your investment portfolio?

It is possible to start a thriving portfolio with an initial investment of just $1,000, followed by monthly contributions of as little as $100. There are many ways to obtain an initial sum you plan to put toward investments.

It is possible to start a thriving portfolio with an initial investment of just $1,000, followed by monthly contributions of as little as $100. There are many ways to obtain an initial sum you plan to put toward investments.

- Start with Your Goals and Time Horizon. ...

- Understand Your Risk Tolerance. ...

- Match Your Account Type with Your Goals. ...

- Select Investments. ...

- Create Your Asset Allocation and Diversify. ...

- Monitor, Rebalance and Adjust.

- Start (or add to) a savings account.

- Invest in a 401(k)

- Invest in an IRA.

- Open a taxable brokerage account.

- Invest in ETFs.

- Use a robo-advisor.

- Invest in stocks.

A good way to minimize risk is by creating a diversified and balanced portfolio with stocks, bonds, and cash that aligns with your short- and long-term goals. From there, you can broaden your portfolio to include other assets like real estate or high-risk investments for an increased likelihood of higher returns.

He said that most of his millionaire clients have about 70% of their assets in retirement accounts like IRAs, 401(k)s, and Roth IRAs. Another 25% or so will typically be in different investment accounts, and then they will have about 5% in cash reserves.

Stocks are a popular investing choice; historically, they have delivered an average yearly return of about 10%. This means that a $1 million investment in the stock market could potentially earn you around $100,000 per year in interest.

Commonly cited rules of thumb suggest subtracting your age from 100 or 110 to determine what portion of your portfolio should be dedicated to stock investments. For example, if you're 30, these rules suggest 70% to 80% of your portfolio allocated to stocks, leaving 20% to 30% of your portfolio for bond investments.

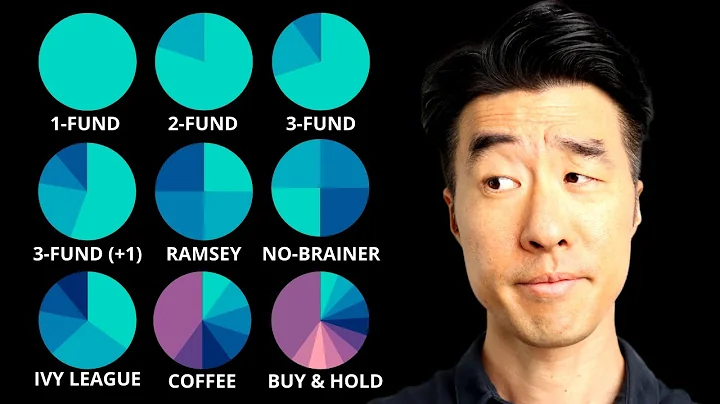

The three-fund portfolio consists of a total stock market index fund, a total international stock index fund, and a total bond market fund. Asset allocation between those three funds is up to the investor based on their age and risk tolerance.

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

What is the safest investment right now?

- Treasury Inflation-Protected Securities (TIPS) ...

- Fixed Annuities. ...

- High-Yield Savings Accounts. ...

- Certificates of Deposit (CDs) Risk level: Very low. ...

- Money Market Mutual Funds. Risk level: Low. ...

- Investment-Grade Corporate Bonds. Risk level: Moderate. ...

- Preferred Stocks. Risk Level: Moderate. ...

- Dividend Aristocrats. Risk level: Moderate.

- Deal with debt.

- Invest in Low-Cost ETFs.

- Invest in stocks with fractional shares.

- Build a portfolio with a robo-advisor.

- Contribute to a 401(k)

- Contribute to a Roth IRA.

- Invest in your future self.

The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age. So if you're 40, you should hold 60% of your portfolio in stocks. Since life expectancy is growing, changing that rule to 110 minus your age or 120 minus your age may be more appropriate.

Conventional wisdom holds that when you hit your 70s, you should adjust your investment portfolio so it leans heavily toward low-risk bonds and cash accounts and away from higher-risk stocks and mutual funds. That strategy still has merit, according to many financial advisors.

The 4% rule is a popular retirement withdrawal strategy that suggests retirees can safely withdraw the amount equal to 4% of their savings during the year they retire and then adjust for inflation each subsequent year for 30 years.

90% Of Millionaires Do It In Real Estate…

90% Of Millionaires Are Made In Real Estate - 100% Of Billionaires Are Made HERE. Private Equity Investing.

| Ticker | Company | % Portfolio |

|---|---|---|

| CNI | Canadian National Railway Co. | 16.29% |

| WM | Waste Management Inc. | 14.92% |

| CAT | Caterpillar Inc. | 5.14% |

| DE | Deere & Co. | 3.36% |

It's definitely possible, but there are several factors to consider—including cost of living, the taxes you'll owe on your withdrawals, and how you want to live in retirement—when thinking about how much money you'll need to retire in the future.

How much you need to live off interest depends entirely on your expenses and where the balance is invested. A million dollars in a retirement account might produce enough income for the median American to get by, but you'd need larger returns to cover a six-figure lifestyle. Consider your lifestyle goals, too.

Can you retire $1.5 million comfortably?

The 4% rule suggests that a $1.5 million portfolio will provide for at least 30 years approximately $60,000 a year before taxes for you to live on in retirement. If you take more than this from your nest egg, it may run short; if you take less or your investments earn more, it may provide somewhat more income.

- Workplace retirement account. If your investing goal is retirement, you can take part in an employer-sponsored retirement plan. ...

- IRA retirement account. ...

- Purchase fractional shares of stock. ...

- Index funds and ETFs. ...

- Savings bonds. ...

- Certificate of Deposit (CD)

Decide how much to invest

As a general rule of thumb, you want to aim to invest a total of 10% to 15% of your income each year for retirement. That probably sounds unrealistic now, but you can start small and work your way up to it over time. (Calculate a more specific retirement goal with our retirement calculator.)

To choose investments for a client, financial advisors start by assessing the investor's tolerance of and capacity for risk. Most advisors operate with model portfolios, which they adapt to suit individual clients' needs and preferences.

Remember that the markets can be ruthless and take away every paisa you invest in it. So, you should only invest what you can afford to lose. Make sure you have sufficient low-risk investments before taking on anything with considerable risk.