What is the VC Fund exemption Advisers Act?

The venture capital fund adviser exemption allows advisers to venture capital funds to avoid certain regulations under the Investment Advisers Act.

To qualify for the venture capital fund adviser exemption, an adviser must only manage a venture capital fund that meets certain requirements. Exempt reporting advisers need not register with the SEC, but they must make an initial filing with the SEC and report certain information annually on Form ADV.

Among other things, the venture exemption requires that, for every fund that the manager advises, no more than 20% of each fund's aggregate capital contributions and uncalled capital commitments be invested in investments that are not venture “qualifying investments”.

Under Section 3(c)(1) of the Investment Company Act of 1940, a “qualifying venture capital fund” is a private fund that remains exempt from registering with the SEC as an investment company by meeting three criteria: It has no more than 250 beneficial owners. It manages no more than $10 million in assets.

The venture capital fund adviser exemption in section 203(l) of the Advisers Act provides an exemption from registration under the Advisers Act for investment advisers that solely advise venture capital funds.

To qualify as a VCOC, the fund must invest at least 50% of its assets in “venture capital investments.” An investment qualifies as a venture capital investment if it is an investment in an “operating company” and the fund obtains specific direct contractual management rights in the portfolio company.

However, private equity firms invest in mid-stage or mature companies, often taking a majority stake control of the company. On the other hand, venture capital firms specialize in helping early-stage companies get the money they need to start building their brand and gaining profits.

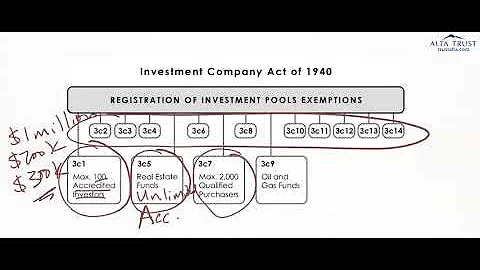

A 3(c)(1) fund allows only 100 accredited investors, or 250 accredited investors if the fund size is less than $10M. A 3(c)(7) fund can accept up to 2,000 qualified purchasers.

The 2 and 20 is a hedge fund compensation structure consisting of a management fee and a performance fee. 2% represents a management fee which is applied to the total assets under management. A 20% performance fee is charged on the profits that the hedge fund generates, beyond a specified minimum threshold.

Venture capital funds usually require a minimum investment of $250,000 to $500,000 and sometimes higher.

What are the three types of venture capital funds?

Types of Venture Capital Funds

Venture Capital Funds are classified on the basis of their utilisation at different stages of a business. The 3 main types are early stage financing, expansion financing, and acquisition/buyout financing. There are 3 sub-categories in early stage financing.

VC firms typically control a pool of funds collected from wealthy individuals, insurance companies, pension funds, and other institutional investors. Although all of the partners have partial ownership of the fund, the VC firm decides how the monies will be invested.

Venture capital (VC) is a form of private equity and a type of financing for startup companies and small businesses with long-term growth potential. Venture capital generally comes from investors, investment banks, and financial institutions.

Section 203(l) generally provides an exemption from SEC registration for investment advisers that provide advice solely with respect to “venture capital funds.” Section 203(m) generally provides an exemption from SEC registration for investment advisers that provide advice solely to private funds and have less than ...

Section 204A of the Advisers Act requires investment advisers (whether SEC-registered or not) to establish, maintain, and enforce written policies and procedures reasonably designed to prevent the misuse of material, nonpublic information by the investment adviser or any of its associated persons.

Advisory Contracts — Consent

Section 205(a)(2) of the Advisers Act generally makes it unlawful for an SEC-registered adviser to enter into or perform any investment advisory contract unless the contract provides that no assignment of the contract shall be made by the adviser without client consent.

The VCOC Exemption

If the venture capital fund qualifies as a VCOC, then the assets of the fund will not be subject to ERISA.

A Venture Capital Operating Company, or VCOC, is a fund in which at least 50 percent of the fund's assets are invested in operating companies in which the fund has direct contractual management rights.

A management rights letter is critical for any venture capital fund that is seeking to rely upon the venture capital operating company (“VCOC”) exemption in order to avoid its assets from being subject to the Employee Retirement Income Security Act of 1974 (“ERISA”) and the onerous requirements that would be imposed ...

Private equity (PE) firms deal with bigger companies, like buying a whole castle. Venture capital (VC) focuses on startups, more like a lemonade stand. Since PE deals are bigger, they have more money to pay their people. So, PE jobs generally pay more than VC.

Is Shark Tank a venture capital?

The sharks are venture capitalists, meaning they are "self-made" millionaires and billionaires seeking lucrative business investment opportunities. While they are paid cast members of the show, they do rely on their own wealth in order to invest in the entrepreneurs' products and services.

This article discusses the advantages and disadvantages of two popular financing options for startups: bootstrap and venture capital. Bootstrap refers to self-funding or using personal savings to launch a business, while venture capital involves securing investment from external sources.

A 3c1 fund is a hedge fund that meets the 3c1 exemption requirements. To qualify, a fund must have fewer than 100 beneficial proprietors and accept investments only from “qualified purchasers” or “accredited investors” as defined by the SEC.

A 3(c)(1) fund is a pooled investment vehicle that is excluded from the definition of investment company in the Investment Company Act because it has no more than 100 beneficial owners (or, in the case of a qualifying venture capital fund, 250 beneficial owners) and otherwise meets criteria outlined in Section 3(c)(1) ...

Certain Look Through Rules

This rule provides that if another 3(c)(1) hedge fund (the “Investor Fund”) owns more than 10% of another 3(c)(1) hedge fund (the “Investee Fund”) then the Investee Fund would count all of the investors of the Investor Fund as investors as well.